omaha ne sales tax rate 2019

Registration Fees and Taxes. Nebraskas sales tax rate is 55 percent.

Nebraska Turnback Tax Grants Decline In 2022 Due To Pandemic Nebraska Examiner

Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GWD72JJSIJPELDS6SGPS56KO3I.jpg)

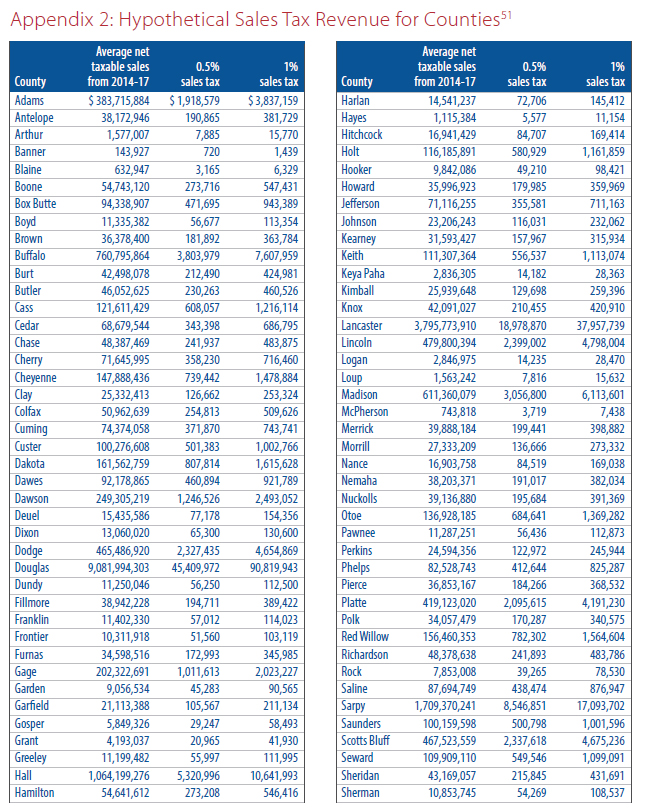

. New local sales and use tax. This is the total of state county and city sales tax rates. State Tax Rates.

This additional local sales tax in many cities places the average combined sales tax rate in Nebraska at around 7 percent although many cities are higher. The local sales tax rate in Omaha Nebraska is 7 as of October 2022. Lawmakers are questioning a proposal that would raise Nebraskas state sales tax and steer the extra revenue into tax credits for low-income residents and property owners.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. What is the sales tax rate in Omaha Nebraska. Here are rates for cities around Omaha.

The sales tax rate in Omaha is 7. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Sales and Use Tax.

The Nebraska state sales and use tax rate is 55 055. There is no applicable county tax city tax or special tax. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Iowas is 6 percent. The bill requires online retailers to collect sales taxes once they have 100000 worth of sales or at least 200 transactions in Nebraska. Request a Business Tax Payment Plan.

The Nebraska state sales and use tax rate is 55 055. The minimum combined 2022 sales tax rate for Omaha Nebraska is. AP Republican gubernatorial challenger Tim James on Wednesday called for a.

The following sales and use tax rate changes will take effect in Nebraska on January 1 2017. Close online purchasing shopping credit card black. Sale tax rates vary from city to city.

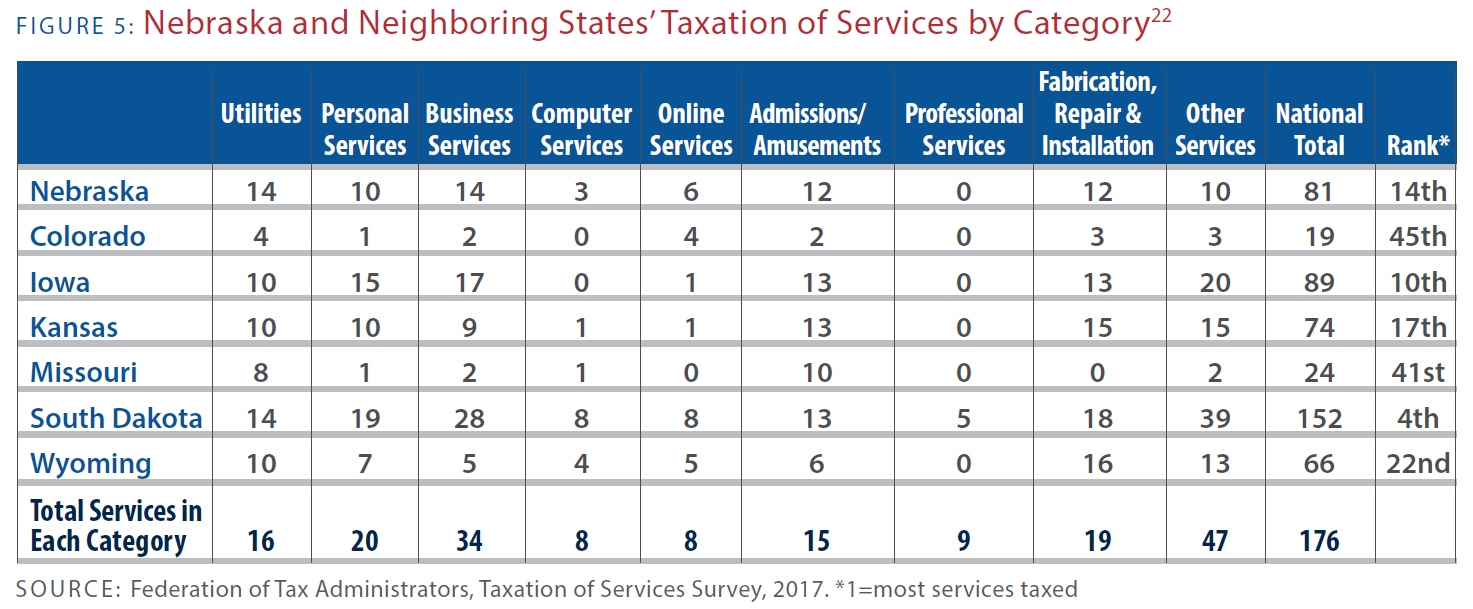

A state sales tax rate of 625 cents would push the state past Iowa 6 cents and make us higher than every neighboring state except Kansas 65 cents. Megan Hunt of District 8 during the first day of the 2019 Legislative Session at the Nebraska. Alice Homan 8 of Omaha pretends to use a telephone alongside her mother Sen.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. May 26 2019. Driver and Vehicle Records.

Papillion NE Sales Tax Rate. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville. The state capitol Omaha has a.

The Nebraska state sales and use tax rate is 55 055. Local sales taxes may. Make a Payment Only.

15 combined rate of 7 Local sales and use. Sales Tax Rate Finder.

Jeep Dealer Near Omaha Gene Steffy Auto Group Fremont

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

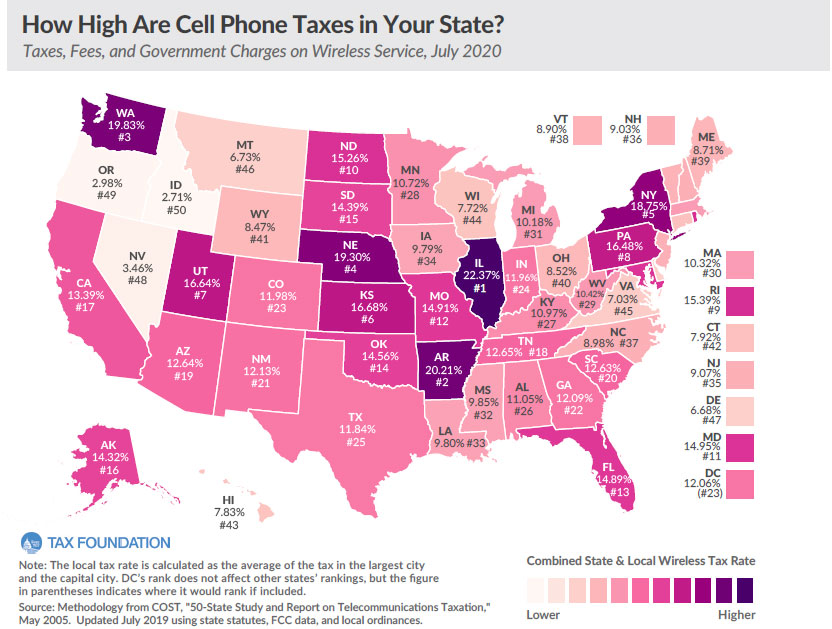

Nebraska Has 4th Highest Wireless Tax Burden In The Nation

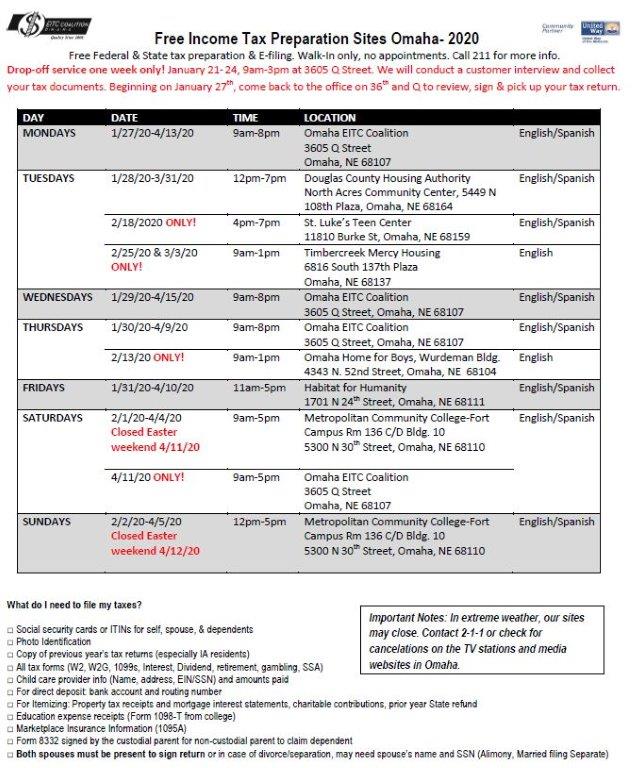

Free Tax Preparation Sites In Omaha Nebraska Department Of Revenue

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Taxes And Spending In Nebraska

Total Gross Domestic Product For Omaha Council Bluffs Ne Ia Msa Ngmp36540 Fred St Louis Fed

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

Used Gmc Acadia For Sale In Omaha Ne Edmunds

How Our Tax Codes Let The Rich Get Richer We Need Better Tax Laws Abc News

Omaha Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Should You Move To A State With No Income Tax Forbes Advisor

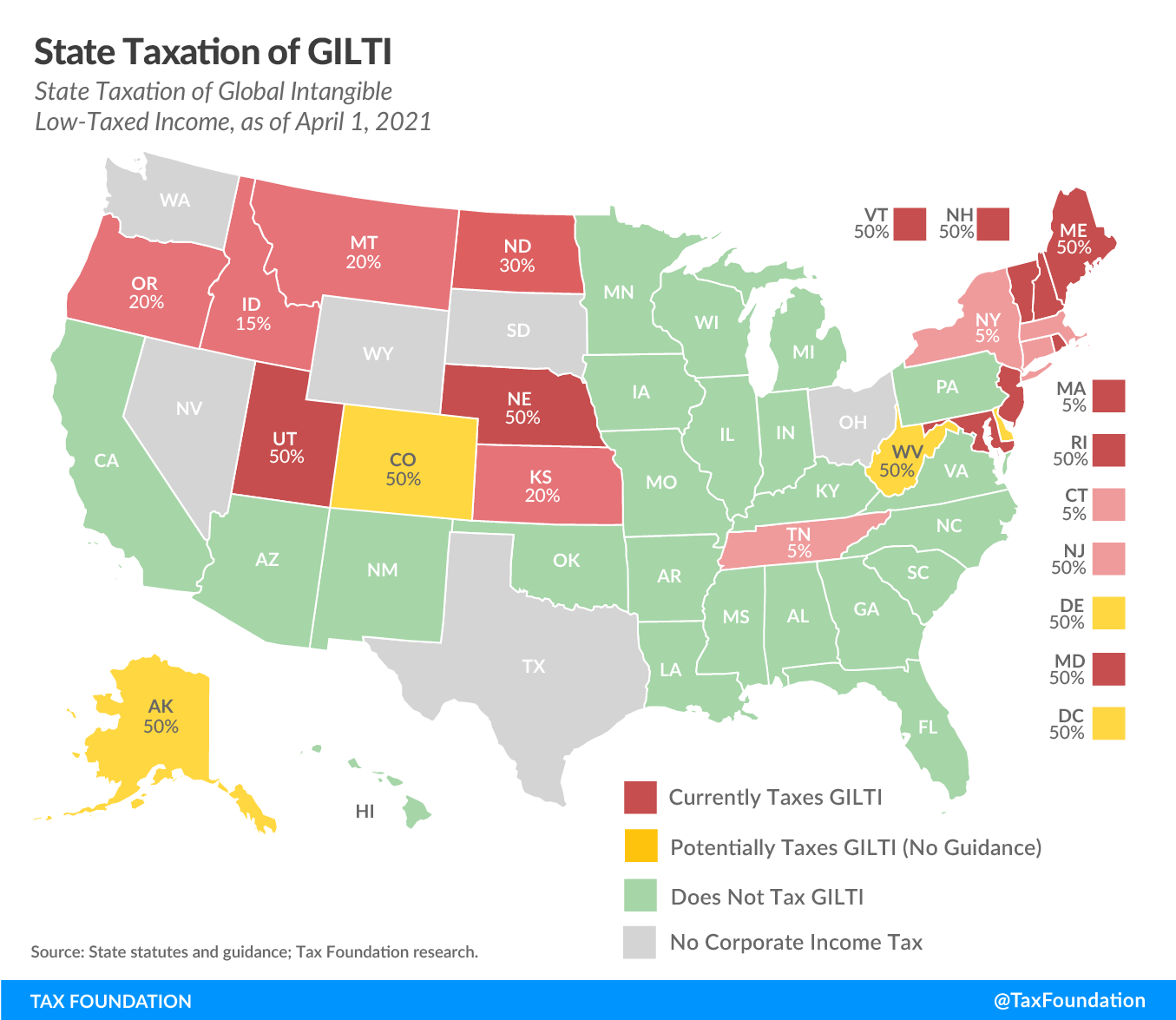

Nebraska Corporate Tax Bill Gilti And Corporate Rate Reduction

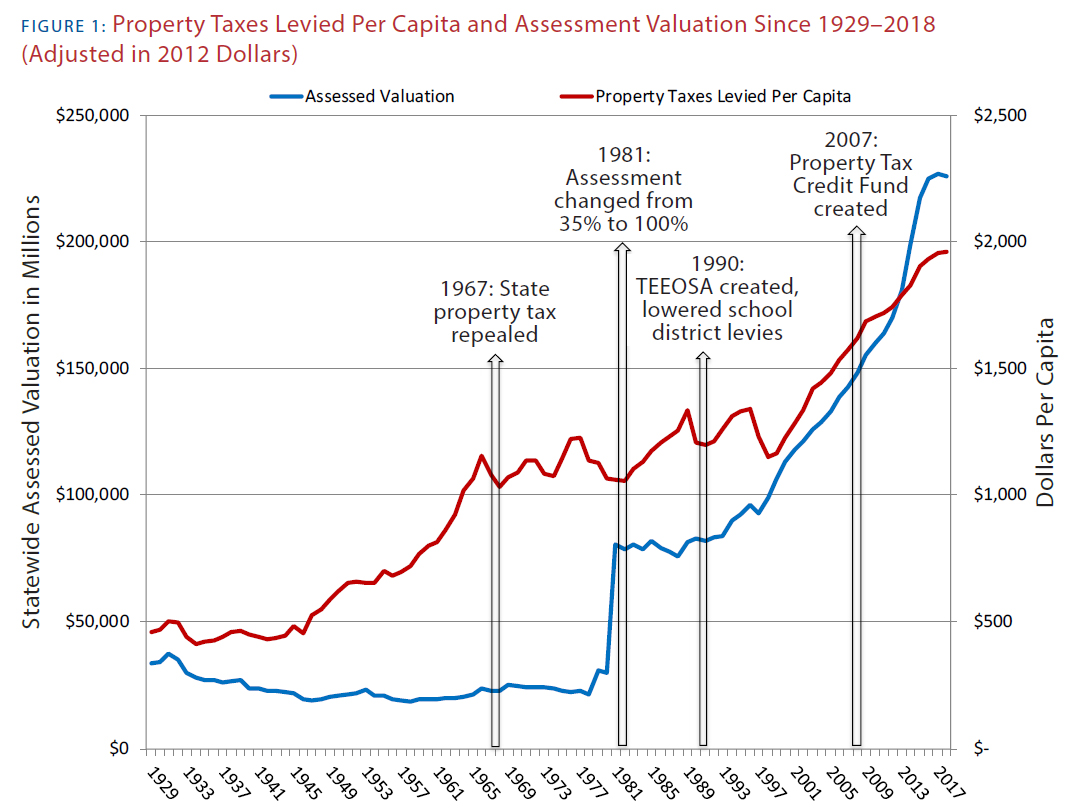

Get Real About Property Taxes 2nd Edition

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare